LEAD-TIME MATTERS

Terry Harris, Managing Partner, Chicago Consulting

American businesses have made dramatic headway at reducing their lead-times to supply customers. In B2B and especially B2C channels customers now receive products they want far faster than just a few years ago. In B2C online selling Amazon continues to set the standard while pushing this envelope to ever smaller delivery times. Other online sellers compare themselves to Amazon with envy and strive to achieve similar results. Most fail.

Amazon’s performance and others’ copying strategies powerfully demonstrates that “lead-time matters”. Not only does it matter, in some situations lead-time trumps all other selection considerations—price, quality and so on. If your house is on fire you need a water hose now; just after a hurricane hits your warehouse you need alternatives right away.

This short lead-time emphasis is not confined to unpredictable emergencies. B2B inventory systems work in ways that make lead-times always matter. A supplier’s lead-time is specific data that resides in their customers’ inventory systems. At the times an item’s on-hand inventory position reaches its re-order point, it needs to be consistently replenished within that specified lead-time. This “reach the re-order point, order the item, receive it” process takes place in every inventory system all the time.

Beyond consistent lead-times, short lead-times help distributors provide high fill rates while keeping inventory investment low. So best are short, consistent lead-times. Not surprisingly, short lead-times inevitably become consistent lead-times.

The lead-time reduction race run by competitors is not for the faint of heart—the more competitive it is the more important it is. Think about two suppliers with lead-times of 10 and 11 days. There’s not much difference—10 percent; it might not even be noticed by prospective buyers. But it gets interesting when nominal lead-times are a few days and less. Then the difference between one and two days is 100%. That difference gets noticed and becomes the reason to buy.

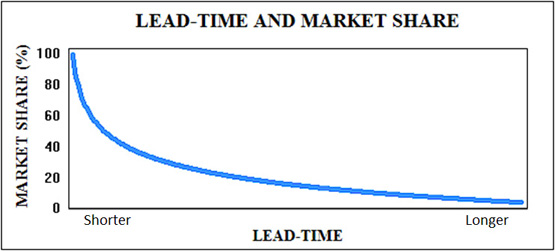

So lead-times matter more the shorter they are. Everything else being equal among competitors, lead-time determines a company’s market share. The relationship looks like this:

If the lead-time race gets tougher in short lead-time markets, the rewards get bigger too. The slope of the curve is steeper for short lead-times, shallower for long ones—more market share uptick from quicker lead-times in short lead-time markets. Of course, on the down side, small lead-time drop-offs cause large market share losses.

This relationship validates Amazon’s strategy. They want to compete on service in general and lead-time specifically. They strive to accelerate their lead-time differences, get ahead of competitors and stay there. They get big market share gains from even modest lead-time improvements.

So valuable does Amazon rank short lead-times they have invested massively in a multi-warehouse, widely-dispersed supply chain designed to get physically close to customers so as to minimize lead-times. Inside warehouses they pick, pack and ship orders within minutes of them being electronically sent. Transportation modes have expanded into new even experimental methods. They operate in the gig economy and are becoming a self-serving carrier.

Rather than sizing them to the products they previously sold Amazon builds huge warehouses knowing there are plenty of new and different products they can stock and sell with their lead-time compression strategy. Unlike most companies they’re not known for what they sell; they’re known for how they sell—fast! And that’s the way they like it.

Given Amazon’s financial performance the company seems willing to sacrifice short term earnings to spend on supply chain infrastructure delivering ever shorter lead-times that increase their market share. This is a serious, high stakes strategy.

Actually lead-time is the essential design driver and the performance metric of all supply chains. It directs the number of and the geographic placement of warehouses, drives operations inside warehouses, guides inventory deployment and decides transportation modes. If not to reduce lead-times why even have supply chains?

Amazon’s web sites draw your attention to fast delivery options. They even put the lead-time comparisons on an hourly scale with messages like

Want it TOMORROW?

Order within 2 hours and 36 minutes

It’s an ingenious physiological perspective shift—referencing the 2 hours and 36 minutes suggests that the time frame in question is a matter of hours rather than the actual days’ worth of real lead-time.

The lead-time/market share relationship illustrated above also drives Amazon’s competitors’ strategies; indeed, all competitors’ strategies. They can’t let others get too far ahead; buyers will increasingly notice the lead-time difference and switch to them. The tail of the pattern means that long lead-time suppliers will suffer flat, low market share—they’re trapped on the bottom. Their only recourse may be to compete on price–too often a suicidal strategy. Competitors ignore this relationship at their peril.

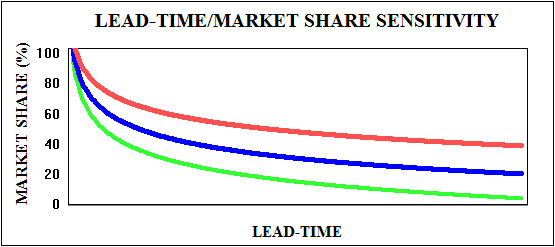

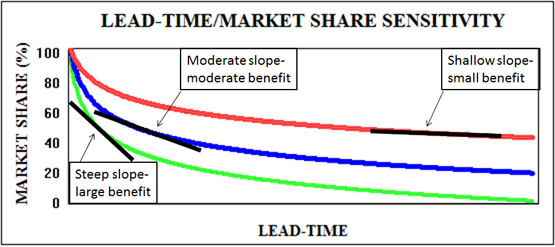

Of course different markets have differing sensitivities to lead-time. Water to fight fires is far more lead-time sensitive than a child’s Halloween costume bought in August. This market-dependent sensitivity is illustrated like this:

Knowing one’s particular pattern is powerful guidance in deciding how much to invest in lead-time reducing efforts. Companies in markets represented by the green relationship need to be more aggressive than those in the blue or red. Organizations that quantify this relationship can be focused by it. The slope of the line at any one point is essentially the “benefit-cost” ratio or, more specifically, the market share gain per lead-time increase.

With the actual experience of what their new warehouses do to lift local market share, you can bet Amazon knows its lead-time/market share relationship with great clarity. Moreover it must be highly sensitive otherwise their growth would be far less dramatic.

Even price differences moderate as companies fulfill and deliver faster; injured people don’t ask for the cheapest ambulance. Lead-time completely trumps price in the extreme. Think about a distributor that doesn’t stock an item some customers want. That supplier could set the price of the item to zero and still never get any orders for it!

For a timely example, supply chain designers take note–Amazon Prime Now offers two hour delivery for free and one hour delivery for $7.99. If other online sellers were anxious about Amazon before they better hold on tight now!

The good news is that lead-times are completely controllable. Short winning lead-times are the result of smart supply chain designs. So lead-time compression strategies that gain market share are available to everyone, not just Amazon.

Lead-time matters a lot. It dictates Amazon’s and their competitors’ strategies, drives supply chain designs, guides compression efforts and frames how American businesses must compete. What could matter more?